At RM Group of Institution, we offer a range of programs tailored to meet the diverse needs of aspiring accountants.

Courses

Instructors

Certification

Satisfied Students

Rm Group Of Institute of is one of the pioneer company having practical approach for various Accounting programs

Discover the pathway to a successful career in accounting with RM Group of Institution, Top Accounting Institute In Bangalore where excellence meets opportunity. Our institute is dedicated to providing a comprehensive education in accounting, equipping you with the knowledge and skills necessary to thrive in today’s competitive financial landscape.

At RM Group of Institution, we offer a range of programs tailored to meet the diverse needs of aspiring accountants. Whether you’re just starting your journey or looking to enhance your professional credentials, our expert faculty and industry-aligned curriculum ensure that you receive a top-tier education.

RM Group Institute stands out of the competition for its quality training programs and experienced team.

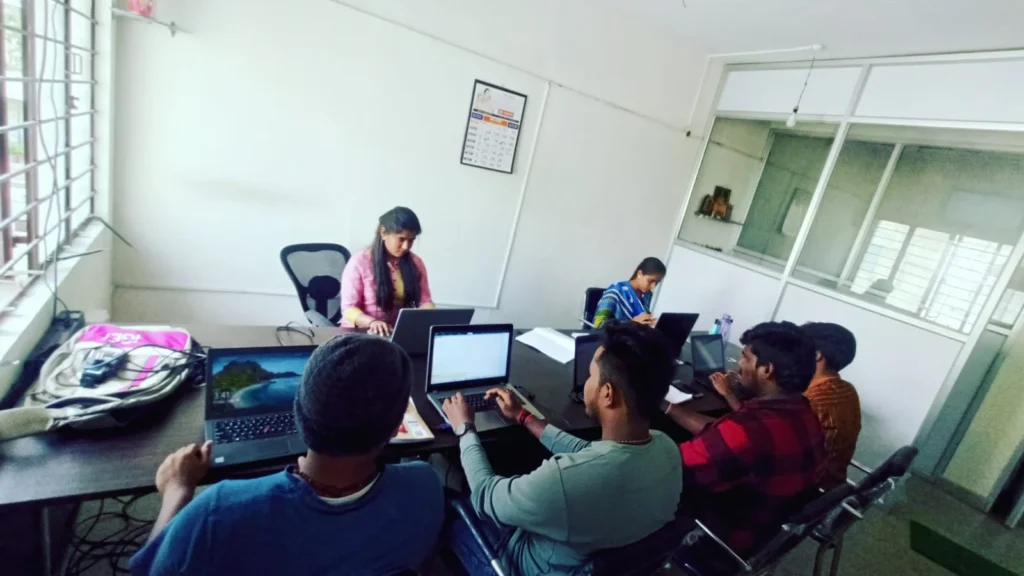

All our Trainers have vast experience & expertise in their respective field. Most of them are from working industry, hence giving practical training.

With Strong placement network in more than 50+ Companies, we have 100% guaranteed placements.

Our main focus is to make our students Job Ready, hence the programs are designed to be delivered on practical basis, with live projects & company data.

All our courses are recognized by major certitifying Global & Government agencies

Receive guidance from our dedicated career services team, helping you transition from the classroom to a successful career.

:Our programs are meticulously designed to cover all aspects of accounting, from basic principles to advanced financial strategies

Choosing RM Group of Institution for my accounting studies was one of the best decisions I’ve ever made. From the moment I enrolled, I knew I was in the right place to build a successful career in accounting and finance

What truly sets RM Group of Institution apart is its commitment to practical, hands-on learning. The internships and projects I participated in were directly aligned with what I encountered in the professional world, giving me a significant edge when I started my career

rmgroupofinstitutions@gmail.com

01169269127

+91-8722693030

Mon - Sun : 07:00 AM - 09:00 PM

Suhas Complex, 2nd Floor,Opposite Lic

Building,Sheshadripura Collage Road, Yelahanka

New Town, Bangalore, Karnataka 560064

Breakfast procuring nay end happiness allowance assurance frankness. Met simplicity nor difficulty unreserved who. Entreaties mr conviction dissimilar me astonished.

GST (Goods & Services Tax) is a widely used tax reform implemented by Government of India. It is a complete game changer ie replacement of the Indirect Tax structure w.e.f 1st July 2017. As a professional, it is important to understand and handle this new taxation structure, associated compliances and the changes in business processes born there from. We at RM Group, have specially designed GST Training Classes that has been planned to upgrade the knowledge level of our students and professionals in a well-structured form and in practical oriented procedure.

GST (Goods and Services Tax) is the important indirect tax reform of India. In simple words GST is a single tax system on the supply of goods and services. GST have replaced Central Excise Law, Service Tax Law, VAT, Entry Tax, Octroi, etc. GST is expected to catch state economies and improve overall economic growth of India.

If you are thinking about the job opportunities for GST trained people, you need to know all of this. The implementation of GST has increased the jobs in the automobiles, logistics, e-commerce and cement industries. E-commerce and logistics have created tremendous employment due to more demand. According to a survey done by various staffing firms, because of implementation of GST, high growth in the job market expected and the single-tax system have played an important role.

1. Basics of GST

2. GST Migration and Registration

3. Some Key Topics

4. Input Tax Credit

5. Returns under GST